Luz Fundoria:

Luz Fundoria: Daily AI Market Insights

Sign up now

Sign up now

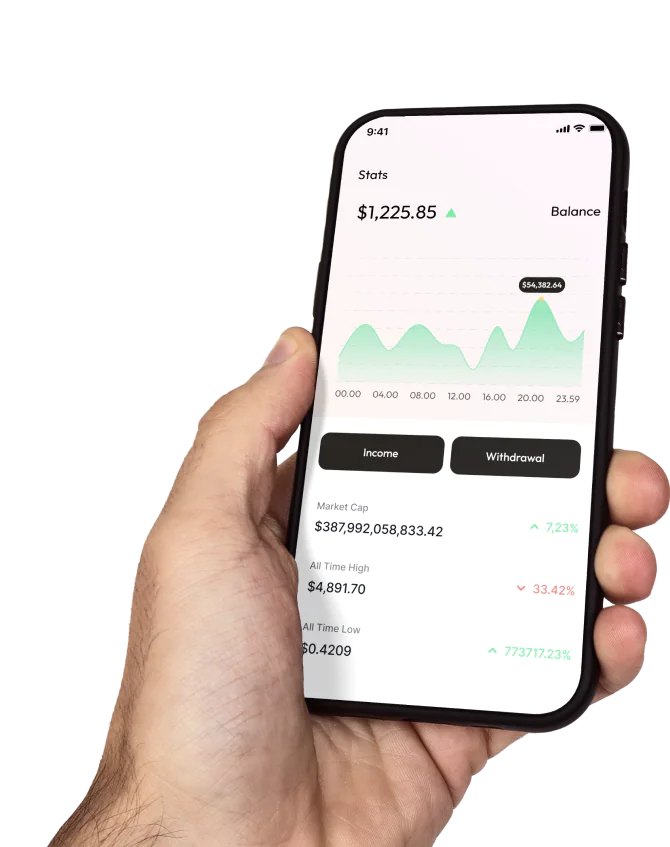

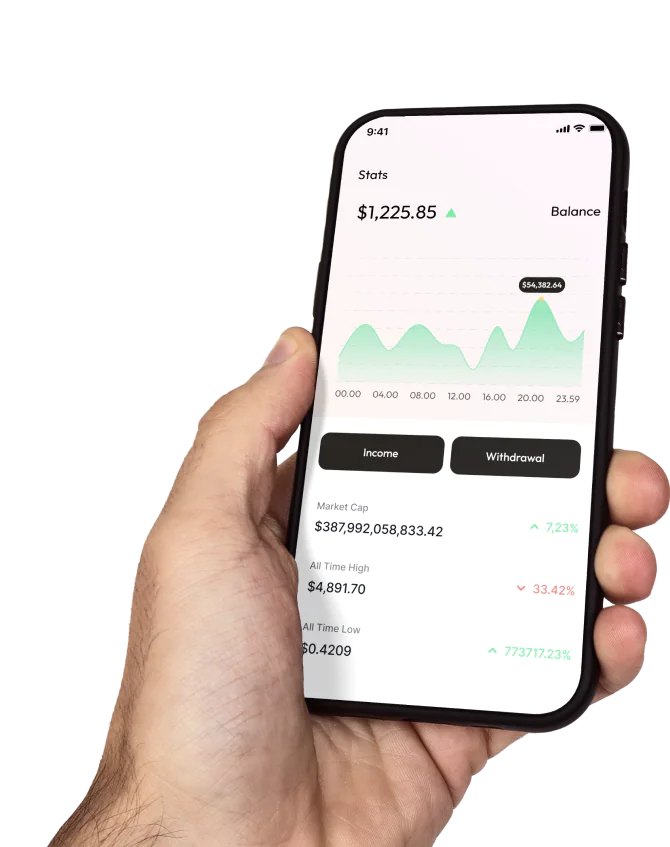

Luz Fundoria tracks live market activity with precision, isolating the movements that truly matter. Instead of cluttered noise, it identifies critical shifts, momentum surges, pauses, and turning points, so you see what drives change immediately.

The platform keeps your focus sharp with a clean layout, highlighting intensity, speed, and participation strength. Data is organized, structured, and actionable, showing meaningful trends instead of scattered signals.

When volatility spikes or markets tighten, Luz Fundoria surfaces high impact setups first. Each signal is rated by strength and urgency, giving you instant clarity and helping you act decisively based on verified market behavior, not guesswork.

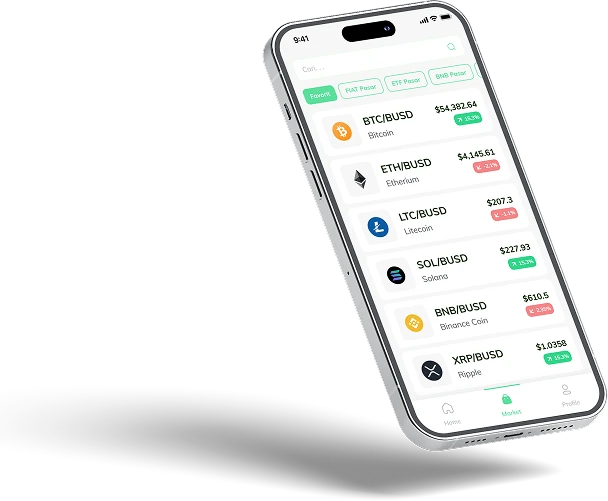

Sudden changes in cryptocurrency trends are detected instantly and presented in concise, actionable summaries. Instead of relying on repetitive charts or historical snapshots, Luz Fundoria highlights emerging directional cues by analyzing live transaction flow. Powered by an AI driven engine, integrated learning modules, optional framework guidance, persistent monitoring tools, a clean interface, and layered security, it ensures users gain immediate situational awareness. Note: Digital asset markets are volatile, and financial loss is possible.

Luz Fundoria dissects market structure by monitoring evolving momentum, liquidity flow, and execution cadence. It highlights when structural changes are underway, identifies contributing forces, and estimates potential continuation. Instead of reacting to fragmented price signals, the platform zeroes in on genuine drivers, turning real time data into actionable insight.

Luz Fundoria monitors shifts in market dynamics by analyzing momentum variations, behavioral sequences, and group activity across different time frames. This method uncovers early inflection points that traditional indicator based charts often miss.

Luz Fundoria delivers structured strategic frameworks derived from proven market practices. Every pathway can be modified, reviewed, or paused as market conditions evolve, giving users total control. All actions remain manual, nothing is automated or executed automatically.

Luz Fundoria protects sensitive data using encrypted access channels combined with role based permissions. User information is compartmentalized to prevent crossover, ensuring isolation at every layer. As the platform does not execute trades, activity logs remain entirely separate from transaction systems. Operations follow strict AI oversight protocols and are reviewed by third parties, with no tracking or profiling of individual trading behavior.

In Luz Fundoria, shifts in market structure, signal intensity, and transaction activity are organized into clear visual clusters. Rapid movements are grouped for easier comprehension, reducing mental strain. Analytical models adapt in real time to different triggers, delivering context sensitive insights. Learning algorithms and optional strategy frameworks operate while full manual control remains with the user.

Rather than reacting to minor fluctuations, Luz Fundoria targets meaningful patterns that typically appear before major directional shifts. It detects early pressure points and momentum spikes, correlating them with timing, market context, and flow dynamics. Abrupt transitions are highlighted clearly without cluttering the interface. With constant monitoring and a streamlined presentation, attention stays on real time developments rather than outdated indicators or repetitive chart data.

Luz Fundoria converts live market activity into concise, actionable insights. Instead of overwhelming you with numbers, it filters only the movements that matter, spotting structural shifts, momentum changes, and early directional cues well before standard market summaries.

By examining transactional patterns in real time, Luz Fundoria identifies emerging directional bias. Each update refines market mapping across multiple layers, highlighting breakout potential while adjusting to speed and volatility. Templates are flexible, keeping your decision making clear and fully manual.

Luz Fundoria runs multi layer validation on every signal as market conditions evolve. Each output is verified against live market activity to filter out anomalies and weak triggers. Only consistently repeatable, well supported confirmations advance through the system, grounding insights in real data rather than recycled assumptions.

Luz Fundoria reacts in real time to unfolding price activity, delivering alerts that align with current market conditions instead of lagging summaries. By instantly detecting and displaying emerging trends, users can make decisions based on present market alignment rather than past data.

Luz Fundoria arranges its tools for maximum efficiency and intuitive use. The clean interface emphasizes clarity and confidence, reducing distractions while aiding informed decision making. Ongoing learning updates and continuous monitoring ensure consistent accuracy. Note: Digital asset markets are highly volatile, and losses are possible.

Luz Fundoria defines strategic planning zones using systematic visual modeling, directional markers, and live force analysis. Instead of reacting to erratic movements, users plan based on verified signals and well established reference levels. The platform does not execute trades and remains fully independent from trading venues.

Adaptive filters eliminate the need for constant chart monitoring, recalibrating automatically as market structure shifts. Learning driven models adjust to evolving conditions, helping users navigate unstable phases and maintain forward looking awareness rather than reactive responses.

Security is ensured through segmented authorization, continuous oversight, and isolated processing layers. Each level controls access to sensitive functions, resulting in a focused analytical workspace that supports calm, structured evaluation amid changing conditions.

Luz Fundoria leverages targeted motion metrics, expansion indicators, regional overlays, and depth aware readings to pinpoint areas where genuine directional momentum is developing. Rather than broad summaries, each alert highlights a distinct situation that deserves careful review.

Trend evolution is analyzed through a layered sequence, considering speed, directional trajectory, and interactions with previous triggers. When multiple pressure signals align, redundant alerts are filtered out, ensuring only stable, repeatable formations command attention.

Luz Fundoria doesn’t wait for full trend reversals, it monitors early changes in acceleration and emerging structural weaknesses. Signals trigger the moment responsive behavior appears, keeping planning in step with live conditions rather than delayed confirmations.

Every strategy has its own timing requirements. Luz Fundoria adjusts automatically: rapid approaches rely on frequent, sensitivity driven cues, while long term methods track broader structural patterns. Each plan is tailored to the pace of the chosen approach instead of generic projections.

Clear visual organization boosts timing assurance. Luz Fundoria observes flow dynamics, compression phases, and early rotational behavior to pinpoint probable activation areas. Important gaps and pivot points are flagged at key levels and ranked for reliability, encouraging careful, considered action rather than reactive decisions.

Luz Fundoria analyzes several possible market scenarios simultaneously, connecting directional probability with structured planning options. By assessing formation strength and past market behavior, users respond more consistently to changing conditions. Results are automatically logged, enhancing preparation and improving long term risk management.

Luz Fundoria creates tailored visual environments by layering analytical dimensions such as directional structure, momentum depth, and force alignment. These composite views highlight critical convergence zones where expansion pressure may build or response phases begin, enabling users to identify readiness areas efficiently.

Focus is placed on detecting loss of drive and emerging rotation. Velocity indicators show slowing activity, while curvature analysis tracks subtle shifts in directional bias. When core signals align with defined planning thresholds, the interface offers clear guidance on whether to observe, prepare, or review actions. The platform is strictly analytical, with no trade execution and no direct exchange connectivity.

To maintain precision, Luz Fundoria filters out minor fluctuations and sharpens time sensitive markers. Adaptive learning models track rhythm changes and recalibrate logic instantly. By emphasizing validated measurements and testing outputs against strict standards, the system provides structured planning pathways grounded in genuine market dynamics rather than surface level noise.

Luz Fundoria monitors real time public engagement signals, tracking activity trends, discussion velocity, headline frequency, and emerging topics, and translates them into actionable behavioral insights. These observations are directly compared with live market responses, ensuring decisions rely on verified movements rather than hype or speculative surges.

Abrupt sentiment swings, emotional spikes, and participation surges are analyzed across multiple sources. Early detection of irregular patterns, sentiment gaps, or rapid reversals allows users to scale their actions based on situational awareness rather than reactive emotion, minimizing cascade effects and supporting composure.

By aligning behavioral indicators with current price activity, Luz Fundoria identifies zones where crowd dynamics influence valuation trends. Alerts flag misaligned sentiment and price before it impacts judgment. The platform remains fully analytical, with no trade execution and no connection to exchanges.

Luz Fundoria scans global developments through a high level analytical lens, considering economic cycles, fiscal policy shifts, regulatory trends, and monetary decisions, linking them directly to price movement. Each factor is assessed for its intensity and timing, helping users distinguish between events with lasting directional impact and those producing fleeting volatility. This separation enables a more precise understanding of long term market sentiment versus temporary reactions.

When external factors trigger price changes, Luz Fundoria maps reactions against historical behaviors and presents structured scenario pathways. By replacing guesswork with visualized context, users can interpret developments thoughtfully rather than responding impulsively to headlines. Digital assets remain volatile; losses are possible.

Luz Fundoria merges structured frameworks with adaptive AI reasoning to provide a clear perspective on market dynamics. By analyzing deviations from expected price levels and recurring participation patterns, it uncovers pressure zones often overlooked in traditional charting.

As new data arrives, internal logic recalibrates in real time, interpreting movement through sequential patterns rather than isolated fluctuations. The interface emphasizes clarity, while optional replication tools allow users to emulate setups without losing control of execution.

When larger market forces shift, Luz Fundoria compares current behavior to long cycle rhythms, creating adaptable frameworks that help prevent impulsive responses during volatility. Users gain context driven preparation rather than reacting to surprises.

AI driven systems in Luz Fundoria detect early compression phases that typically signal upcoming breakouts. Vulnerable zones and formative regions are flagged before broader patterns emerge, providing guidance during the buildup stage prior to significant market movement.

Luz Fundoria organizes rapid and irregular price activity into layered, readable structures. By presenting behavioral cues, risk boundaries, and directional summaries clearly, it reduces emotion driven decisions and supports planned execution. Cryptocurrency markets remain volatile, and financial losses are possible.

With AI supported analysis, Luz Fundoria interprets sharp market moves, subtle retreats, and unpredictable surges. Chaotic patterns are reorganized into meaningful warnings, providing structured awareness of developing trends beneath the surface. The system transforms market uncertainty into informed, practical observation.

Luz Fundoria combines advanced analytical automation with expert market logic to interpret complex price movements, identify tension in transaction flow, and highlight critical inflection points. By tracking behavioral sentiment, participation shifts, and pressure imbalances, it provides consistent directional insight without performing any trade execution.

Its continuously cycling intelligence core recalibrates outputs in real time, maintaining reliable interpretation during sudden expansions or sharp reversals. In the volatile world of digital assets, where losses are possible, Luz Fundoria prioritizes structured analysis and disciplined awareness to support controlled exposure management.

Absolutely. Luz Fundoria is designed to welcome users of any skill level. Guided walkthroughs, preconfigured views, and intuitive tools simplify complex concepts, allowing newcomers to engage confidently without prior market knowledge.

The platform provides organized signal clusters covering short term direction, behavioral patterns, and sentiment trends. Each signal is categorized and scored by confidence, making it easy to spot stable zones, caution areas, and emerging opportunities in real time.

Yes. Users can fully customize the dashboard to match their workflow. Layouts, filters, and focus modules are adjustable, keeping relevant information visible whether tracking a single asset or multiple scenarios simultaneously.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |